Zutec Acquires Createmaster for SEK 50.2 million – a Leading U.K. Cloud and Services Platform for Main Contractors and Developers

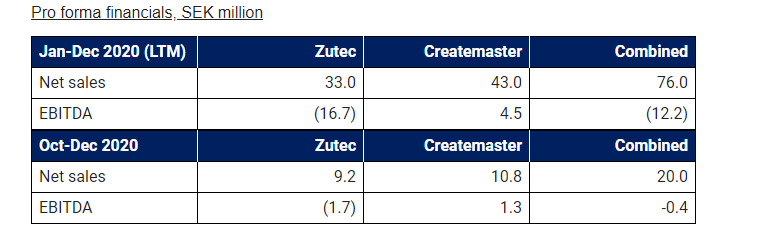

Dublin, Ireland, 19 April 2021 – Zutec Holding AB (publ) (“Zutec”) has today acquired all outstanding shares in Createmaster Limited (“Createmaster”) from Brian Dodsworth & Jane Ann Dodsworth (the “Transaction”). Createmaster, based in London, UK and founded in 2002, is a leading construction platform for main contractors and developers. On a preliminary basis, Createmaster had net sales of GBP 3.7 (SEK 43.0) million and EBITDA of GBP 0.3 (SEK 4.5) million during the twelve months period ending 31 December 2020. Createmaster has demonstrated impressive annual growth over the past 10 years in excess of 25% p.a. and consistent double-digit EBITDA margins.

The initial consideration consists of an initial cash consideration of GBP 2.4 (SEK 28.1) million and 1,836,229 newly issued Zutec shares (equivalent to GBP 0.95 (SEK 11.0) million). Subject to fulfilment of agreed financial targets in the next two years, an additional cash consideration of maximum GBP 0.95 (SEK11.1) million may be paid at the end of year 2. Zutec will assume Createmaster’s existing cash of GBP 0.5 (SEK 5.8) million and interest-bearing debt of GBP 0.5 (SEK 5.8) million.

Gustave Geisendorf, CEO of Zutec: ”The acquisition of Createmaster is transformational for Zutec and Createmaster fits all of Zutec’s criteria for a strategic acquisition; Createmaster has scale, strong brands, leading market positions in one of our four defined home markets, same focus as Zutec in the construction value chain, provides complimentary products and services, well-established customer base, strong and dedicated management team and compelling financials. We are thrilled to welcome Brian and his team to Zutec to continue the very exciting journey that Createmaster has already started.”

Brian Dodsworth, MD of Createmaster: ”The acquisition of Createmaster by Zutec, unites complimentary, best in breed, product and service propositions and provides greater access to markets, knowledge and resources that means in working together we’ll deliver market leading levels of service to all our customers, in the maturing digital construction marketplace. We look forward to joining and working with Gustave and his team, as our journey continues.”

Background and strategic rationale

Createmaster was founded in 2002 and is to date fully owned by Brian Dodsworth & Jane Ann Dodsworth. Createmaster is based in London, UK with over 70 employees in total and caters exclusively to the U.K. market. Createmaster offers a leading Cloud-based platform for handovers for main contractors and developers, providing unparalleled knowledge of UK contractors’ digitisation journey. Createmaster focuses primarily on the handover and documentation phase of the construction value chain, where Createmaster is estimated to have a c. 10% share of the UK new construction market. With a strong management team lead by Brian Dodsworth, Createmaster has achieved consistent double-digit and profitable annual net sales growth. Createmaster will operate as an entity under Zutec and will continue being managed by Brian Dodsworth. Createmaster has a diversified Tier 1 customer list including a large number of major UK contractors.

- The acquisition provides Zutec with a leading platform in the UK market and increases Zutec’s UK market share from below 1% to over 10%.

- Substantially increase the scale of Zutec from net sales of SEK 33.0 million to proforma net sales of SEK 76.0 million.

- Createmaster adds DocumentPark and Resi-sense to Zutec’s product portfolio. DocumentPark is a cloud-based platform for contractors providing handover data to owners. Resi-sense is a cloud-based platform for building owners providing digital home user guides.

- Ability for Zutec and Createmaster to cross-sell each platform providing complimentary functionality and benefits.

- The acquisition will serve as a key steppingstone for further similar acquisitions in Zutec’s home markets.

Transaction structure

Createmaster will be operating as a subsidiary of Zutec Holding AB. The consideration of the Transaction has been paid as an upfront consideration and a sales based earn-out.

Initial consideration as follows:

- Initial cash consideration of GBP 2.4 million, and

- 1,836,229 newly issued Zutec shares at a subscription price of SEK 6.00 per share, which is equivalent to a consideration of GBP 0.95 (SEK 11.0) million. 50% of the newly issued shares will be subject to a lock-up agreement for 12 months and 50% subject to a lock-up agreement for 24 months. The total number of outstanding shares will after the Transaction amount to 46,090,618 shares, equivalent to a 4.1% increase.

Sales based earn-out consideration as follows:

- Earn-out consideration to be a maximum of GBP 0.95 (SEK 11.1) million in case sales growth of Createmaster exceeds 10% p.a;

- Earn-out period is for the period starting July 1, 2021 and two years thereafter;

- Earn out will be paid in one instalment in cash after year 2.

Completion of the transaction

The Transaction has completed and Createmaster has been consolidated into Zutec. The initial cash consideration and transaction expenses will be financed with existing cash resources.

Walker Morris and Eversheds Sutherland acted as legal advisors to Zutec in the Transaction.

For further information, please contact

Gustave Geisendorf, CEO

Tel: +353 1 21 3565

Email: gustave.geisendorf@zutec.com

This is information that Zutec Holding AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact person set out above, on April 19, 2021 at [8.30] CET.

About Zutec

Zutec is a provider of cloud-based construction management software with offices in Dublin, London and Melbourne. Zutec Holding AB (publ) is listed on Nasdaq First North Growth Market and Redeye AB is the Company’s acting Certified Adviser (Tel. +46 8 121 576 90, certifiedadviser@redeye.se, www.redeye.se).

Createmaster’s financials have been restated from UK GAAP to IFRS. Pro forma financials are based on the last twelve months (LTM) period ending 31 December 2020 and the last three month period ending 31 December 2020. Createmaster’s current financial year-end of 31 May will be changed to 30 June, as part of the acquisition.